FORWARD THINKING VISIONARIES

Gleipnir is an entrepreneurial visionary in all things; the industry problems we’ve identified, the solutions we propose, the business model we’ve formed, and the method through which we capitalize.

WHO IS GLEIPNIR

OrganizationGleipnir, Inc. is a United States C-Corporation headquartered in the State of Tennessee.

JurisdictionGleipnir is a Tennessee corporation. Tennessee is the 3rd fastest growing economy in the United States and home to multiple multi-national corporations, including several S&P index companies. The state treasury is stable and generally considered among the top 5 strongest state treasuries in the United States. Important for our purposes, Tennessee is a blockchain friendly state with no state income tax and is usually considered among the top 10 states in “freedom indices”, an important marker for blockchain organizations.

OperationsGleipnir will operate with a tokenholder elected Board of Directors which appoints executive management to operate the day-to-day affairs of the company. We will hold board nominations and elections soon after the Offering closes.

WHAT WILL GLEIPNIR DO

Upon completion of our Offering, Gleipnir will establish wholly owned investment advisor subsidiaries around the world to offer managed crypto index portfolios to retail and institutional investors. By creating wholly owned subsidiaries, Gleipnir is enabled to successfully operate within the regulatory confines, fiat currency, language, and culture of different global jurisdictions. Gleipnir is the only business in the world with such a business model, which will quickly place Gleipnir in a dominant market position.

HOW IS GLEIPNIR DIFFERENT

Drawing on years of real-world professional experience, Gleipnir has identified several barriers to mainstream crypto investing, impediments which, if not overcome, will impede blockchain’s growth. The result is a gap between investors and crypto. Gleipnir will be the bridge that successfully connects retail investors and crypto. Gleipnir is the only financial business in the world dedicated to overcoming these barriers, which will quickly place Gleipnir in a dominant market position.

HOW WILL GLEIPNIR GROW

GeographicallyGleipnir will establish operations in multiple crypto-friendly countries with a high crypto adoption rate and/or fast-growing crypto adoption rate.

Products and ServicesGleipnir will begin operations with professionally managed crypto index portfolios.

Managed Crypto Portfolio – professionally managed crypto index portfolios are not available to retail investors on a large scale. Gleipnir will create a new global business model by being the first company to offer professionally managed crypto portfolios to retail investors on a large scale, which will quickly place Gleipnir in a dominant market position.

Gleipnir will then expand its offerings to include:

Multi-Asset Crypto ETF – there are no multi-asset crypto ETF available in the world today. Gleipnir will break ground by being the first company to offer a multi-asset crypto ETF, which will quickly place Gleipnir in a dominant market position.

Multi-Asset Crypto Mutual Fund – there are no multi-asset crypto mutual funds available in the world today. In fact, there are no crypto mutual funds available. Gleipnir will forge a new product by being the first company to offer multi-asset crypto mutual funds, which will quickly place Gleipnir in a dominant market position.

Crypto Hedge Fund – there are very few crypto hedge funds managed by seasoned financial professionals. Gleipnir’s experience will quickly dominate the crypto hedge fund market.

Crypto Venture Capital Fund – there are not many global crypto venture capital funds managed by experienced financial professionals with visionary foresight. Gleipnir’s experience will enable it to quickly identify the most promising start-ups led by the most talented developers and entrepreneurs.

Crypto Separately Managed Accounts – there are no separately managed crypto accounts available to global investment advisors today. Gleipnir will transform the industry by being the first to offer separately managed crypto accounts, which will quickly place Gleipnir in a dominant market position.

Gleipnir expects that there will be other, as yet unthought of, opportunities as blockchain grows and matures.

WHAT IS THE POTENTIAL FOR BLOCKCHAIN

Gleipnir cannot say what blockchain will become any more than the Wright brothers could say what would become of the airplane or Henry Ford could say what would become of the automobile, but we know that both the airplane and automobile changed the world forever.

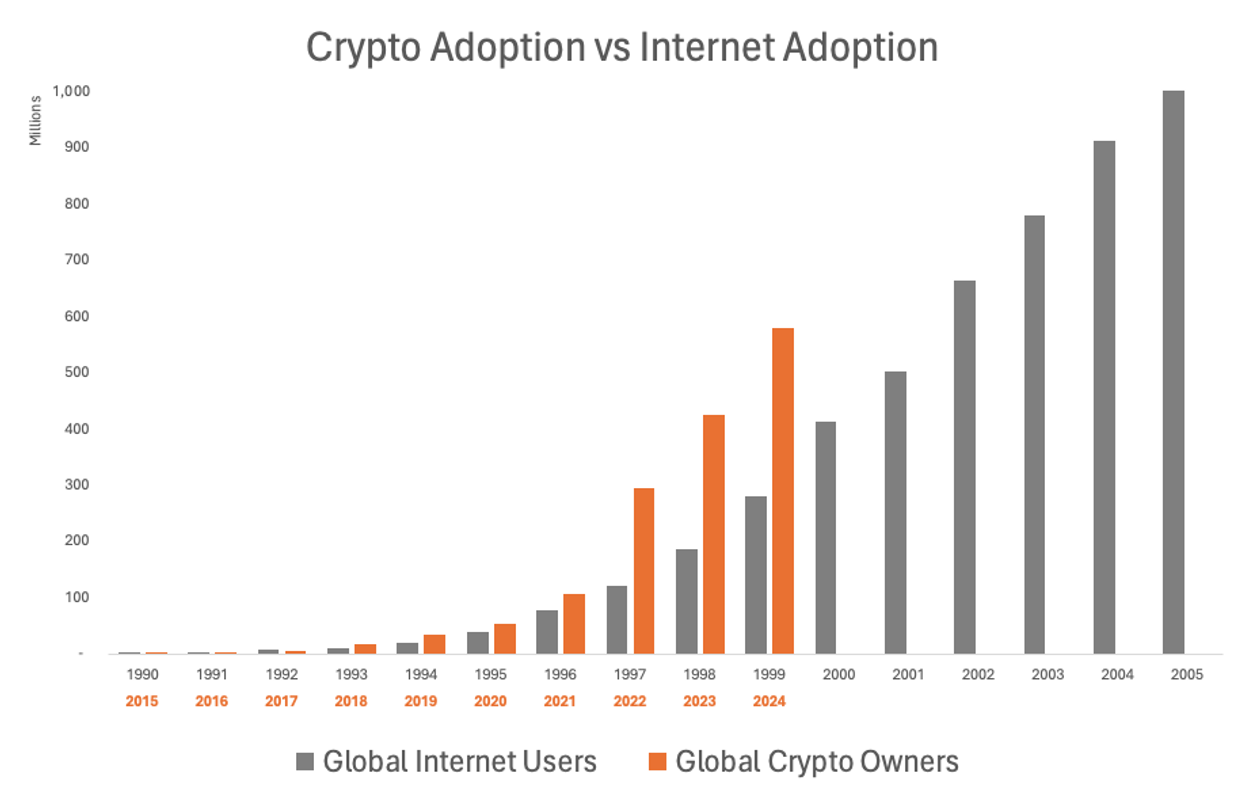

Blockchain is being adopted at a faster rate than internet adoption in the 1990’s. Gleipnir expects that over the next 10 years blockchain will become the worlds primary means of communication and data storage, tokenization will become the world’s primary method of investing, and cryptocurrencies will become the world’s preferred currency.

WHAT IS THE POTENTIAL FOR BLOCKCHAIN

Gleipnir’s potential is literally incalculable.

99% of retail investors use a professional financial intermediary of some sort:

- 35% of retail investors use a Financial Advisor.

- 52% of retail investors use Mutual Funds.

- 12% of retail investors use ETF.

The ideal crypto allocation for retail investors is 10% - 20% of their portfolio.

- Global Equity Markets Are Valued At $109 Trillion.

- 10% allocation is $11 Trillion.

- 20% allocation is $22 Trillion.

Crypto also encompasses other asset classes.

- Global Debt Market is $235 Trillion.

- Global Real Estate Market is $6.1 Trillion

- 10% allocation is $24 Trillion

- 20% allocation is $48 Trillion.

Crypto is currently a $2.5 Trillion asset class with the potential to become a $35 - $70 Trillion asset class; a 1,300% - 2,700% increase in value.

- Global currency markets are at $7.5 Trillion daily trading volume.

- 10% allocation is $750 Billion daily trading volume.

- 20% allocation is $1.5 Trillion daily trading volume.

Crypto also includes other asset classes, such as tokenized equities, art and music rights, collectibles (Wine, Whiskey, …), and much more.

Crypto’s potential value is literally incalculable, which means Gleipnir’s potential is incalculable.

However, we can examine history to learn what happened to companies which used new technology to break down barriers for consumers.

- Bill Gates and Microsoft … anyone can operate a computer.

- Steve Jobs and Apple … anyone can afford a computer

- Sam Walton and Walmart … one-stop shopping.

- Jeff Bezos and Amazon … open global retail market.

- Mark Zuckerberg and Facebook … connect far flung friends & family.

- Elon Musk and Tesla … EV can be sold at affordable prices.

- Gleipnir … anyone can invest in digital assets & use blockchain.

Investors who believed in the vision of these transformative entrepreneurs have been richly rewarded.

Gleipnir’s potential is limited only by our far-sighted vision of what blockchain can become and our belief that crypto can transform the world for the better.